Related Document

Avino Silver & Gold Mines Ltd. (ASM: TSX/NYSE American, GV6: FSE, “Avino” or “the Company”) is pleased to announce initial drill results from Phase 1 of the drill campaign which was announced as part of the Company’s exploration plans for 2021.

“The results of this initial drill program are encouraging as we had some significant grades hit at each location,” said David Wolfin, President and CEO. “We will integrate this information into our geological model to improve our understanding as we continue to look for economic deposits similar to our San Gonzalo mine while at the same time looking to add M&I resources at our Avino mine. We have been test targeting a few holes at a time to determine potential areas to further focus on, as well as building a database of geological information.”

The reported results below are from the El Trompo Vein, the Santiago Vein, and the recently announced La Malinche Vein.

El Trompo Vein:

The El Trompo Vein is a priority target as it is an offshoot of the Avino Vein, which has been one of the feeder veins for the Company’s milling complex. Historical data indicates there are high grade areas within the vein over considerable widths, and there is underground infrastructure adjacent to the vein, which would allow access for mining. The structure has already been exposed and developed on the upper levels in the ET Area of the Avino Vein. Drilling on this vein has been from surface to confirm continuity of the mineralization at depth.

Table 1: El Trompo Vein - Summary of Drilling – 8 holes and 1,569 metres

Hole Number | From | To | Length (m) | Au (g/t) | Ag (g/t) | Cu (ppm) | Pb (ppm) | Zn (ppm) | AgEq (g/t) |

TR-21-01 | 182.90 | 183.85 | 0.95 | 0.56 | 177.00 | 35,000 | 540 | 670 | 577 |

TR-21-02 | 228.45 | 231.00 | 2.70 | 0.03 | 32.00 | 3,000 | 180 | 1,900 | 71 |

TR-21-03 | 101.80 | 104.55 | 2.75 | 0.42 | 276.00 | 1,000 | 2,900 | 1,000 | 322 |

TR-21-04 | 139.80 | 141.65 | 1.85 | 0.08 | 37.00 | 1,000 | 1,200 | 2,700 | 64 |

TR-21-05 | 115.00 | 116.00 | 1.00 | 0.02 | 8.00 | 1,300 | 40 | 3,500 | 33 |

TR-21-06 | 161.35 | 165.75 | 4.40 | 0.11 | 47.00 | 2,100 | 1,600 | 700 | 82 |

TR-21-07 | 124.35 | 127.15 | 2.80 | 0.01 | 2.00 | 170 | 100 | 1,600 | 9 |

TR-21-08 | 182.05 | 183.90 | 1.85 | 0.01 | 1.00 | 0 | 20 | 5600 | 4 |

*AgEq in drill results assumes $1,800 Au and $26.00 Ag per ounce, and $4.25 Cu, $1.00 Pb., and $1.25 Zn per pound., and 100% metallurgical recovery.

The recent El Trompo drilling has demonstrated continuity along 250 m of strike at a depth pf 120 m below surface.

Santiago Vein:

The Santiago vein lies further north in the Avino mining district in an area of narrow veins that average 1 to 2 metres in width and intersects the San Gonzalo vein with mineralization similar to the historically high-grade San Gonzalo silver-gold mineralization. The San Gonzalo mine previously produced 6 million ounces of silver equivalent until closing in 2019. The continuity of the mineralization of the Santiago vein is being tested, as well as an apparent displacement by the San Gonzalo fault. This target will be drilled from surface. Because of the close proximity to San Gonzalo underground infrastructure, mining access is close by if significant mineral resources are found.

Table 2: Santiago Vein - Summary of Drilling – 7 holes and 1,451 metres (Assays from 1 hole outstanding)

Hole Number | From | To | Length (m) | Au (g/t) | Ag (g/t) | Cu (ppm) | Pb (ppm) | Zn (ppm) | AgEq (g/t) |

ST-21-01 | 158.35 | 160.10 | 1.75 | 0.09 | 25 | 1,720 | 315 | 1,230 | 53 |

ST-21-02 | 171.00 | 171.60 | 0.60 | 0.18 | 33 | 154 | 712 | 2,080 | 55 |

ST-21-03 | 124.15 | 125.85 | 1.70 | 0.13 | 16 | 234 | 661 | 3,420 | 39 |

ST-21-04 | 202.60 | 203.40 | 0.80 | 2.62 | 643 | 2,500 | 2,605 | 2,918 | 865 |

ST-21-04 | 337.30 | 338.05 | 0.75 | 0.04 | 2 | 32 | 101 | 80 | 6 |

ST-21-05 | Did not intersect the vein |

|

|

|

|

|

|

|

|

ST-21-06 | 199.05 | 199.20 | 0.15 | 0.017 | 23 | 3,280 | 116 | 200 | 59 |

*AgEq in drill results assumes $1,800 Au and $26.00 Ag per ounce, and $4.25 Cu, $1.00 Pb., and $1.25 Zn per pound., and 100% metallurgical recovery.

La Malinche Vein:

The La Malinche vein has been tested by six holes and the assays are shown in Table 3. The style of mineralization intersected resembles the low-sulphidation epithermal San Gonzalo vein. This vein may represent a northwestern fault-dislocated extension of the San Gonzalo vein.

More exploration work will be conducted to confirm this concept and broaden understanding of the system.

Table 3: La Malinche - Summary of Drilling – 8 holes at 600 metres (Assays from 2 holes outstanding)

Hole Number | From | To | Length (m) | Au (g/t) | Ag (g/t) | Cu (ppm) | Pb (ppm) | Zn (ppm) | AgEq (g/t) |

LM-21-01 | 53.35 | 53.85 | 0.50 | 0.44 | 9 | 630 | 5,724 | 18,248 | 114 |

LM-21-02 | 77.60 | 77.85 | 0.25 | 0.12 | 23 | 2,980 | 539 | 282 | 64 |

LM-21-03 | 76.05 | 77.45 | 1.40 | 0.12 | 5 | 475 | 451 | 402 | 20 |

LM-21-04 | 76.05 | 77.45 | 1.40 | 1.68 | 252 | 11,700 | 9,390 | 103,000 | 820 |

LM-21-04 | 90.05 | 90.20 | 0.15 | 0.04 | 26 | 4,610 | 278 | 1,490 | 81 |

LM-21-05 | 70.75 | 72.10 | 1.35 | 0.65 | 61 | 4,914 | 4,716 | 5,674 | 185 |

LM-21-06 | 85.30 | 86.20 | 0.90 | 1.56 | 364 | 28,778 | 7,411 | 616 | 786 |

*AgEq in drill results assumes $1,800 Au and $26.00 Ag per ounce, and $4.25 Cu, $1.00 Pb., and $1.25 Zn per pound., and 100% metallurgical recovery.

True Widths cannot be determined with the available information.

These drill results are encouraging as the presence of mineralized material in the La Malinche Vein has been shown to extend along a strike distance of 250 metres and to a depth of 75 metres from surface. The 650 metre gap between the La Malinche vein and the northwest termination of the San Gonzalo vein remains prospective.

Current Drilling Highlights

As at July 9, 2021, the total meterage drilled is as follows:

- El Trompo Vein - 1,569 metres

- Santiago Vein - 1,717 metres

- La Malinche – 820 metres

- Oxide tailings – 1,701 metres

Testing on other known veins in the area are as follows:

- Nuestra Senora – 340 metres

- San Jorge – 133 metres

Assays of samples are pending for these areas as well as two holes for La Malinche.

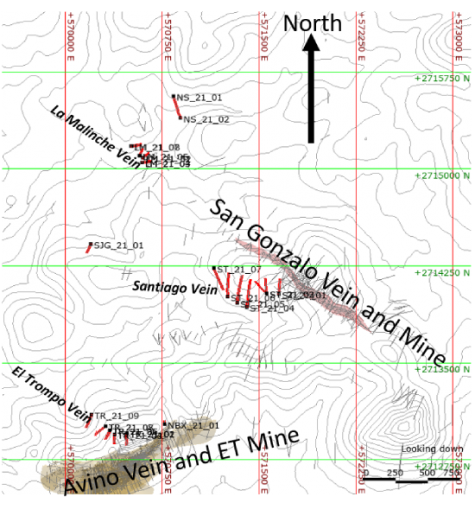

Figure 1. 2021 Drilling and vein Locations (Topography contours at 20m intervals)

In addition, a new interpretation of the Avino footwall vein adjacent to the El Trompo vein is being probed and 400 metres has been drilled. Assays of the samples are currently pending.

Oxide Tailings Resource Drilling

Avino is currently infill drilling the oxide tailings resource that sits within our tailings storage facility #1 (“TSF#1”). We have 200 holes planned of which we have drilled approximately 57 holes. Assays of the samples are pending. In 2017, Avino released an encouraging Preliminary Economic Assessment (“PEA”), which can be found on Avino’s profile on SEDAR. One of the recommendations from the PEA was to perform additional surface drilling to increase the confidence level of the resource. This would be done in anticipation on commencing a Pre-Feasibility Study (“PFS”). Avino is currently proceeding with the recommended drilling with the intention of making a decision to proceed with a PFS later in the year.

Qualified Person(s)

Avino’s projects in Durango, Mexico are under the geoscientific oversight of Michael O’Brien, P.Geo., Senior Principal Consultant, Red Pennant Communications, and under the supervision of Peter Latta, P.Eng, Avino’s VP, Technical Services, who are both qualified persons within the context of NI 43-101. Both have reviewed and approved the technical data in this news release.

About Avino

Avino is primarily a silver producer with a diversified pipeline of silver, gold, and base metal properties in Mexico. Avino produces from its wholly owned Avino Mine near Durango, Mexico. The Company’s silver and gold production remains unhedged. The Company’s mission and strategy is to create shareholder value through its focus on profitable organic growth at the historic Avino Property and the strategic acquisition of mineral exploration and mining properties. We are committed to managing all business activities in a safe, environmentally responsible and cost-effective manner, while contributing to the well-being of the communities in which we operate.

On Behalf of the Board

“David Wolfin”

________________________________

David Wolfin

President & CEO

Avino Silver & Gold Mines Ltd.

Safe Harbor Statement - This news release contains “forward-looking information” and “forward-looking statements” (together, the “forward looking statements”) within the meaning of applicable securities laws and the United States Private Securities Litigation Reform Act of 1995, including the updated mineral resource estimate for the Company’s Avino Property located near Durango in west-central Mexico (the “Property”) with an effective date of January 13, 2021 prepared for the Company, and reference to Measured, Indicated, Inferred Resources referred to in this press release. These forward-looking statements are made as of the date of this news release and the dates of technical reports, as applicable. Readers are cautioned not to place undue reliance on forward-looking statements, as there can be no assurance that the future circumstances, outcomes or results anticipated in or implied by such forward-looking statements will occur or that plans, intentions or expectations upon which the forward-looking statements are based will occur. While we have based these forward-looking statements on our expectations about future events as at the date that such statements were prepared, the statements are not a guarantee that such future events will occur and are subject to risks, uncertainties, assumptions and other factors which could cause events or outcomes to differ materially from those expressed or implied by such forward-looking statements. No assurance can be given that the Company’s Property has the amount of the mineral resources indicated in the updated report or that such mineral resources may be economically extracted.

Such factors and assumptions include, among others, the effects of general economic conditions, the price of gold, silver and copper, changing foreign exchange rates and actions by government authorities, uncertainties associated with legal proceedings and negotiations and misjudgments in the course of preparing forward-looking information. In addition, there are known and unknown risk factors which could cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements. Known risk factors include risks associated with project development; the need for additional financing; operational risks associated with mining and mineral processing; the COVID-19 pandemic; volatility in the global financial markets; fluctuations in metal prices; title matters; uncertainties and risks related to carrying on business in foreign countries; environmental liability claims and insurance; reliance on key personnel; the potential for conflicts of interest among certain of our officers, directors or promoters with certain other projects; the absence of dividends; currency fluctuations; competition; dilution; the volatility of the our common share price and volume; tax consequences to U.S. investors; and other risks and uncertainties. Although we have attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. We are under no obligation to update or alter any forward-looking statements except as required under applicable securities laws. For more detailed information regarding the Company including its risk factors, investors are directed to the Company’s Annual Report on Form 20-F and other periodic reports that it files with the U.S. Securities and Exchange Commission.

References to Measured & Indicated Mineral Resources and Inferred Mineral Resources in this press release are terms that are defined under Canadian rules by National Instrument 43-101 (“NI 43-101”). U.S. Investors are cautioned not to assume that any part of the mineral resources in these categories will ever be converted into Reserves as defined under SEC Industry Guide 7.