Related Document

Avino Silver & Gold Mines Ltd. (ASM: TSX/NYSE American, GV6: FSE, “Avino” or “the Company”) is pleased to announce drill results from the Oxide Tailings (“TSF #1”) Project that sits within our tailings storage facility #1 (#TSF#1) on the Avino property.

The 2022 drill program included 17 drill holes for a total of 209 metres of drilling. The drilling follows up the 2021 drill program, the results of which were released on April 7, 2022 and can be viewed on our website. The drill holes were added to step out from the current known footprint of the historic oxide tailings deposit to capture the total tailings resource. As mentioned in the previous news release, a comprehensive sampling program is underway to collect samples for an upcoming metallurgical testing program. Once completed and assuming results are positive, the existing PEA will be used as the framework for an updated study with the intention of advancing the project to Pre-Feasibility Study level.

The drill results are located below including the total meters drilled:

| SULPHIDE ZONE | OXIDE ZONE - RECENT | ||||||

| N° | HOLE ID | DEPTH (m) |

Au (g/t) |

Ag (g/t) |

DEPTH (m) |

Au (g/t) |

Ag (g/t) |

| 1 | PJ-22-01 | 6.00 | 0.24 | 29 | |||

| 2 | PJ-22-02 | 6.00 | 0.21 | 26 | |||

| 3 | PJ-22-03 | 9.00 | 0.22 | 24 | |||

| 4 | PJ-22-04 | 9.00 | 0.28 | 32 | |||

| 5 | PJ-22-05 | 9.00 | 0.38 | 42 | |||

| 6 | PJ-22-06 | 10.30 | 0.46 | 37 | |||

| 7 | PJ-22-07 | 10.50 | 0.38 | 39 | |||

| 8 | PJ-22-08 | 1.50 | 0.20 | 20 | 7.50 | 0.46 | 50 |

| 9 | PJ-22-09 | 3.00 | 0.36 | 34 | 7.50 | 0.36 | 34 |

| 10 | PJ-22-10 | 3.00 | 0.43 | 44 | 6.00 | 0.34 | 42 |

| 11 | PJ-22-11 | 4.50 | 0.35 | 38 | 4.50 | 0.41 | 44 |

| 12 | PJ-22-12 | 7.50 | 0.22 | 23 | 1.50 | 0.35 | 39 |

| 13 | PJ-22-13 | 4.50 | 0.40 | 29 | |||

| 14 | PJ-22-14 | 13.50 | 0.53 | 39 | 7.50 | 0.73 | 53 |

| 15 | PJ-22-14-A | 13.50 | 0.39 | 28 | 10.50 | 0.79 | 42 |

| 16 | PJ-22-15 | 7.50 | 0.33 | 29 | 10.50 | 0.52 | 34 |

| 17 | PJ-22-16 | 1.50 | 0.28 | 25 | 6.00 | 0.40 | 39 |

| Total Metres and Average Grade | 90 | 0.34 | 30 | 91 | 0.49 | 41 | |

As the holes are drilled vertically the mineralization represents true width (depth)

“These results highlight the continuity of the tailings grade beyond the previous known deposition footprint,” said David Wolfin, President and CEO. “The gold grade in the oxide portion of the recent holes is encouraging and given the distance of the step out holes, we feel this will provide meaningful resource expansion significantly beyond what was described in the previous PEA. The Oxide Tailings project factors prominently into the Company’s growth strategy to achieve intermediate producer status.”

Oxide Tailings Project

The Oxide Tailings is located to the southwest of the Avino mine and mill and is the current tailings facility for the Avino mill. Over Avino’s 54-year history the mine has operated for various periods of time and as such, generated different types of tailings. There are 3 distinct zones of oxide tailings identified that correspond to the timeline of extraction from the previous historic operations. The historic oxides are tailings that were generated prior to the 1980’s from the open pit mine on Avino’s property. The recent oxides consist of tailings from the processing operation from the 1980’s until the late 1990’s. Finally, the sulfide tailings are the recent tailings from when the operation recommenced in 2011. However as indicated in the above table, the holes drilled in 2022 covered only 2 zones, leaving out the historic oxide zone.

Avino is advancing its dry stack tailings project and when complete will decommission the current tailings pond, potentially opening this area to development and reprocessing.

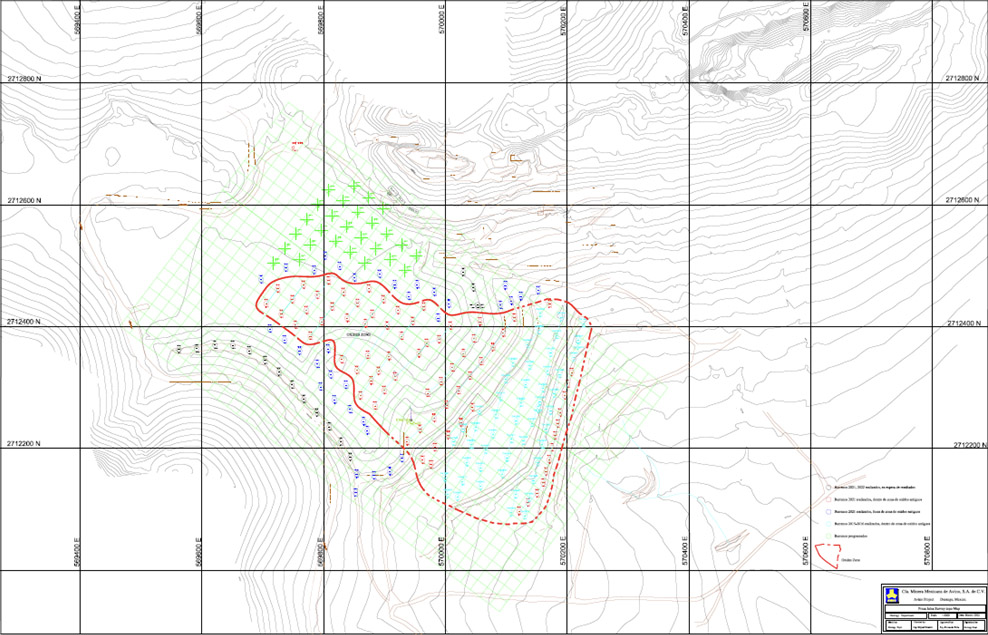

The tailings were drilled with a 2” sonic drill, which was drilled to the depth of the underlying bedrock. The use of the sonic drilling technique provides high quality information and representative granulometry and grade samples and demonstrates Avino’s commitment to technical excellence. The bedrock is sloped so that the depth of each hole can vary significantly depending on the drill hole location. The full table which can be also found on our website under Oxide Tailings Drill Data, details the depth and assay values of each layer of tailings, noting that some of the holes penetrated more than one layer of tailings. The figure below shows the drill holes in plan view.

Figure 1 shows the oxide tailings in plan view with the drill holes in Black from the 2022 drill program, the drill holes in Red and Blue from the 2021 program, the green indicates holes that may still be drilled, and the drill holes in light blue from the 2015/2016 program.

Sampling and Assay Methods

Following detailed geological and geotechnical logging, drill core samples are cut in half. One half of the core is submitted to SGS Laboratory facility in Durango, Mexico, and the other half is retained on-site for verification and reference. Gold is assayed by fire assay with an AA finish. Any samples exceeding 3.0 gold grams/tonne are re-assayed and followed by a gravimetric finish. Multi-element analyses are also completed for each sample by SGS ICP14B methods. Silver is fire assayed with a gravimetric finish for samples assaying over 100 grams/tonne.

Avino uses a series of standard reference materials (SRMs), blank reference materials (blanks), and duplicates as part of their QA/QC program during analysis of assays.

Qualified Person(s)

Avino’s projects in Durango, Mexico are under the geoscientific oversight of Michael F. O’Brien, P.Geo., Senior Principal Consultant, Red Pennant Communications, and under the supervision of Peter Latta, P.Eng, Avino’s VP, Technical Services, who are both qualified persons within the context of NI 43-101. Both have reviewed and approved the technical data in this news release.

About Avino

Avino is primarily a silver producer from its wholly owned Avino Mine near Durango, Mexico. The Company’s silver, gold and copper production remains unhedged. The Company’s mission and strategy is to create shareholder value through its focus on profitable organic growth at the historic Avino Property and the strategic acquisition of mineral exploration and mining properties. We are committed to managing all business activities in a safe, environmentally responsible, and cost-effective manner, while contributing to the well-being of the communities in which we operate. We encourage you to connect with us on Twitter at @Avino and on LinkedIn at Avino Silver & Gold Mines. To view the Avino Mine VRIFY tour, please click here.

On Behalf of the Board

“David Wolfin”

________________________________

David Wolfin

President & CEO

Avino Silver & Gold Mines Ltd.

This news release contains “forward-looking information” and “forward-looking statements” (together, the “forward looking statements”) within the meaning of applicable securities laws and the United States Private Securities Litigation Reform Act of 1995, including the amended mineral resource estimate for the Company’s Avino Property located near Durango in west-central Mexico (the “Avino Property”) with an effective date of January 13, 2021, and as amended on December 21, 2021, and the Company’s updated mineral resource estimate for La Preciosa with an effective date of October 27, 2021, prepared for the Company, and references to Measured, Indicated, Inferred Resources referred to in this press release. These forward-looking statements are made as of the date of this news release and the dates of technical reports, as applicable. Readers are cautioned not to place undue reliance on forward-looking statements, as there can be no assurance that the future circumstances, outcomes or results anticipated in or implied by such forward-looking statements will occur or that plans, intentions or expectations upon which the forward-looking statements are based will occur. While we have based these forward-looking statements on our expectations about future events as at the date that such statements were prepared, the statements are not a guarantee that such future events will occur and are subject to risks, uncertainties, assumptions and other factors which could cause events or outcomes to differ materially from those expressed or implied by such forward-looking statements. Such factors and assumptions include, among others, the effects of general economic conditions, the price of gold, silver and copper, changing foreign exchange rates and actions by government authorities, uncertainties associated with legal proceedings and negotiations and misjudgments in the course of preparing forward-looking information. In addition, there are known and unknown risk factors which could cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements. Known risk factors include risks associated with project development; the need for additional financing; operational risks associated with mining and mineral processing; the COVID-19 pandemic; volatility in the global financial markets; fluctuations in metal prices; title matters; uncertainties and risks related to carrying on business in foreign countries; environmental liability claims and insurance; reliance on key personnel; the potential for conflicts of interest among certain of our officers, directors or promoters with certain other projects; the absence of dividends; currency fluctuations; competition; dilution; the volatility of the our common share price and volume; tax consequences to U.S. investors; and other risks and uncertainties. Although we have attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. We are under no obligation to update or alter any forward-looking statements except as required under applicable securities laws. For more detailed information regarding the Company including its risk factors, investors are directed to the Company’s Annual Report on Form 20-F and other periodic reports that it files with the U.S. Securities and Exchange Commission.

References to Measured & Indicated Mineral Resources and Inferred Mineral Resources in this press release are terms that are defined under Canadian rules by National Instrument 43-101 (“NI 43-101”). On October 31, 2018, the US Securities and Exchange Commission adopted Item 1300 of Regulation S-K (“Regulation SK-1300”) to modernize the property disclosure requirements for mining registrants, and related guidance, under the Securities Act of 1933 and the Securities Exchange Act of 1934. All registrants are required to comply with Regulation SK-1300 for fiscal years ending after January 1, 2021. Accordingly, the Company must comply with Regulation SK-1300 for its fiscal year ending December 31, 2021, and thereafter, and the Company will no longer utilize Industry Guide 7. Regulation SK-1300 uses the Committee for Mineral Reserves International Reporting Standards (“CRIRSCO”) based classification scheme for mineral resources and mineral reserves, that includes definitions for inferred, indicated, and measured mineral resources. U.S. Investors are cautioned not to assume that any part of the mineral resources in these categories will ever be converted into probable or proven mineral reserves within the meaning of Regulation S-K 1300.